TRU NEWS

All disclosure filings, including news releases and financial documents can be found on the TRU Precious Metals SEDAR page.

TRU Closes $617,000 Non-Brokered Private Placement

TRU Precious Metals Corp. is pleased to announce the closing of a non-brokered private placement for gross proceeds of $617,000.

Toronto, Ontario – December 22, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce the closing of a non-brokered private placement for gross proceeds of $617,000 (the “Offering”). The Company raised gross proceeds of $500,500 from the issuance of flow-through units (“FT Units”) at a price of $0.065 per FT Unit. Each FT Unit is comprised of one (1) “flow-through” common share in the capital of the Company (a “FT Share”), and one half (0.5) of one flow-through common share purchase warrant (a “FT Warrant”), with each full FT Warrant entitling the holder thereof to purchase one (1) common share in the capital of the Company on a “non-flow-through” basis (a “Share”) at a price of $0.10 for a period of 24 months following December 21, 2022 (the “Closing Date”). The FT shares and FT Warrants will qualify as flow-through shares within the meaning of subsection 66(15) of the Income Tax Act and it is intended that the FT Units will qualify for the Critical Minerals Exploration Tax Credit. The sole subscriber for the FT Units was a flow-through fund.

The Company also raised gross proceeds of $116,500 from the issuance of hard dollar units (“HD Units”) at a price of $0.055 per HD Unit. Each HD Unit is comprised of one (1) Share and one (1) Share purchase warrant (a “HD Warrant”), with each HD Warrant entitling the holder thereof to purchase one (1) Share at a price of $0.08 for a period of 36 months following the Closing Date.

The Company will use the Offering proceeds from the issuance of FT Units to explore areas at its flagship Golden Rose Project in Central Newfoundland that are primarily prospective for critical minerals including copper, with an intended focus on the copper-bearing Jacob’s Pond trend and specifically the Jacob’s Twin target and nearby targets. The Offering proceeds from the issuance of HD Units will be used for working capital purposes.

Subscriptions by insiders of the Company for HD Units accounted for $45,000 of the gross proceeds of the Offering. Participation by insiders in the Offering is exempt from the valuation and minority shareholder approval requirements of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions by virtue of the exemptions contained in Sections 5.5(b) and 5.7(1)(b).

The securities issued are subject to a statutory hold period expiring April 22, 2023. The Offering is subject to final approval of the TSX Venture Exchange.

In connection with the Offering, GloRes Securities Inc. acted as finder and received cash commissions totaling $38,885, and 609,000 finder warrants, each of which entitles the holder thereof to purchase one (1) Share at a price of $0.10 for a period of 24 months following the Closing Date.

The securities issued pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Separately, the Company is reporting that it has allowed the license for its Stony Lake Property to lapse.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 236 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploration activities at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose that are believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; regulatory approval processes; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Acquires 100% Ownership of Altius’ Golden Rose Project

TRU Precious Metals Corp. is pleased to announce that it has concurrently exercised three option agreements to acquire 100% ownership of the Company’s flagship Golden Rose Project, as described below (Figure 1), located in the highly prospective Central Newfoundland Gold Belt.

Toronto, Ontario – November 30, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that it has concurrently exercised three option agreements to acquire 100% ownership of the Company’s flagship Golden Rose Project (“Golden Rose” or the “Project”), as described below (Figure 1), located in the highly prospective Central Newfoundland Gold Belt.

TRU Co-Founder & CEO Joel Freudman commented, “Acquiring 100% ownership of Golden Rose earlier than initially contemplated or required is a testimony to our confidence that there is much more discovery potential to uncover. Since optioning the Project from TSX-listed Altius Minerals Corporation in May 2021, we have worked with determination and prudence as we tactically consolidated the most prospective claims within and surrounding Golden Rose, alongside exploring the Project. We are now the sole owners of this formidable land package, flanked on either side by deposit-bearing neighbours. We intend to expand TRU's pipeline of drill-ready targets across the Project through relatively low-cost, but high-upside, exploration methods, to ultimately prepare for what we are hopeful will be an exciting 2023 drill program.”

The Company has exercised the following option agreements:

Option Agreements with Altius and Shawn Rose

On May 12, 2021, TRU announced that it had closed a definitive option agreement with a subsidiary of TSX-listed Altius Minerals Corporation (“Altius”), by which Altius granted to TRU the exclusive right and option (the “Altius Option”) to acquire, subject to retention by Altius of a maximum 2.0% net smelter return royalty (“NSR”), its 100% interest in a package of mineral claims located in the southwestern portion of the Central Newfoundland Gold Belt (the “Altius Claims”).

In connection with the Altius Option, Altius also assigned to TRU a supplementary option agreement under which Shawn Rose granted TRU the exclusive right and option (the “Rose Option”) to acquire, subject to retention by Shawn Rose of a 2.0% NSR, his 100% interest in certain surrounding mineral claims known as the Rose Gold claims (the “Rose Claims”).

Collectively, the Altius Claims and the Rose Claims formed the initial basis of Golden Rose. The Company has subsequently more than doubled the size of Golden Rose through a series of other transactions.

TRU has now exercised the Altius Option as well as the accompanying Rose Option by issuing 1,400,000 common shares of TRU (“TRU Shares”) to Altius at a deemed price of $0.25 per share, and paying $37,500 in cash to Shawn Rose, pursuant to the terms of the respective option agreements. The Company previously satisfied all other terms of such agreements, including the requirement under the Altius Option to incur $3,000,000 of exploration expenditures prior to February 2024.

Figure 1: Golden Rose Project Property Location and Ownership Map

Option Agreement for King George IV Lake Claims

On July 13, 2021, the Company entered into an option agreement with an arm’s length individual under which TRU was granted the exclusive right and option (the “KG4 Option”) to acquire, subject to retention by the optionor of a 2.0% NSR, 100% interest in certain claims along the shoreline of King George IV Lake, all of which are contiguous with Golden Rose. Further details are available in the Company’s press release dated July 14, 2021.

TRU has exercised the KG4 Option by issuing to the optionor 100,000 TRU Shares at a deemed price of $0.08 per share, and an additional 500,000 TRU Shares at a deemed price of $0.08 per share in a shares for debt transaction in satisfaction of a $40,000 cash-or-shares payment obligation. These payments were due to be made by July 13, 2023.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt on its 100%-owned Golden Rose Project, originally optioned from TSX-listed Altius Minerals. Golden Rose is a regional-scale 236 km2 land package, including a recently-discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project. In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two claim packages covering 33.25 km2 including a 12 km strike length along the Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploration activities at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose that are believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; regulatory approval processes; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Announces Visible Gold and High-Grade Gold Results from Rock Samples Collected in Mark’s Pond and Rich House Targets at Golden Rose

Mark’s Pond trench grab samples return assay results as high as 1,929 g/t Au

TRU announces high-grade gold results from a recent rock (grab) sampling program conducted on the Company’s claims under option at its Golden Rose Project in Central Newfoundland.

Mark’s Pond trench grab samples return assay results as high as 1,929 g/t Au

Toronto, Ontario – November 23, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce high-grade gold results from a recent rock (grab) sampling program conducted on the Company’s claims under option at its Golden Rose Project (“Golden Rose”) in Central Newfoundland. The bedrock and float grab sample results are very encouraging and indicate the high-grade gold potential at the Company’s Mark’s Pond and Rich House targets located along the highly prospective Cape Ray-Valentine Lake Shear Zone.

Highlights

Visible gold is evident in outcrop and in bedrock grab samples collected from a recently extended trench at Mark’s Pond. The grab samples were taken from a sheared volcaniclastic and graphitic unit containing a significant number of quartz-carbonate veins. Mapping and channel sampling within the trench have confirmed the presence of visible coarse- and fine-grained gold both within these quartz-carbonate veins and the surrounding wall rock along a newly discovered shear zone approximately 130 m northwest of the Mark’s Pond Gold Zone.

Three bedrock grab samples collected from newly exposed outcrop in the Mark’s Pond trench have returned very high-grade gold assay results from total pulp metallics analysis (metallic screening) including weighted average total Au values of 1,929 g/t Au, 205.6 g/t Au, and 180.1 g/t Au (Table 1 and Figure 2).

Four bedrock grab samples collected at the Rich House target along the northern shore of Victoria Lake returned weighted average total Au values between 4.3 and 16.8 g/t Au from metallic screening analysis (Table 1 and Figure 1).

A series of channel samples have been collected in the recently excavated 275 m long trench at Mark’s Pond including a 23 m long easterly extension at the southern end of the trench along strike of the gold-bearing volcaniclastic and graphitic shear zone. Those assay results are pending from the laboratory.

TRU Co-Founder and CEO Joel Freudman commented:

“We are very encouraged by these grab sample results from the Mark’s Pond and the Rich House targets, which have revealed very impressive gold grades and suggest that substantial gold mineralization is present along this 4 to 5 km long structural trend north of Victoria Lake. Based on these grab sample results, we look forward to receiving the gold assay results from our channel sampling program, which should help us characterize the grade consistency and potential width of this newly discovered gold-bearing shear zone. This new data along with the expected results from the channel sampling program will assist us in prioritizing the Mark’s Pond and Rich House targets for our 2023 drilling program. We have been very deliberate in locking up this Golden Rose district scale land package, and early results from this field program confirm our strategy of building this out to be a turn-key project.”

Figure 1: Grab Sample Results at Mark’s Pond and Rich House Targets

Figure 2: Grab sample results within Mark’s Pond trench

Technical Summary

The Company recently completed its fall exploration program where it collected a number of soil, till, and rock (grab) samples from various locations in the Mark’s Pond and Rich House target areas, where historical exploration had identified several gold showings. Visible disseminated fine-grained and coarse-grained free gold was evident in panned soil and till samples, outcrops, and within several rock samples collected in the recently extended trench at Mark’s Pond. A total of 3 bedrock grab samples were collected from newly-exposed outcrops in the Mark’s Pond trench. A total of 5 bedrock grab samples were collected from outcrops at Rich House during recent prospecting to confirm historical gold results. Three float samples were also collected 575 m southeast of the Mark’s Pond Gold Zone and returned assay results between 1.0 to 8.5 g/t Au.

The grab sample assay results are shown in Figures 1 and 2 and summarized below in Table 1. The anomalously high-grade gold result received at Mark’s Pond (1,929 g/t Au) was returned from a 1.2 kg bedrock sample taken from a sheared volcaniclastic and graphitic unit with visible gold in the Mark’s Pond trench. The TRU geologist collected three clean bedrock grab samples at various locations within the trench prior to commencing channel sampling. TRU instructed Eastern Analytical Ltd. (“Eastern Analytical”) to complete a total pulp metallics analysis for each submitted sample due to the presence of coarse gold and the nugget effect potentially affecting a typical fire assay result. Because the screen metallic analysis for this sample returned an anomalously high gold value, Eastern Analytical completed several internal QAQC checks and reruns to verify the high-grade gold result was precise prior to its final release. Readers are cautioned that grab samples are selective by nature, and the gold values reported may not represent the true grade or style of mineralization at Mark’s Pond.

Table 1: Gold assay results from screen metallic analysis of grab samples at Mark’s Pond and Rich House targets

Note: Weighted average total gold assay results shown above were determined using Total Pulp Metallic analysis (metallic screening) to mitigate the nugget effect of coarse visible gold in the samples. Sample weights are shown in grams (g) and gold values are shown in grams per tonne (g/t). Numbers have been rounded.

Channel Sampling Program – Mark’s Pond Trench

TRU has collected a series of channel samples within the recently excavated 275 m long trench including a 23 m long easterly extension at the southern end of the trench along strike of the gold-bearing volcaniclastic and graphitic shear zone (Figure 2). The trench is located approximately 130 m north of the historically drilled Mark’s Pond Gold Zone. The Mark’s Pond trench was extended to the north to test a second, multiple line, east-west trending historical gold-in soil anomaly that had not been previously trenched or drilled. A high-resolution drone (UAV) imagery survey has been completed by Insite Surveys of Burgeo, NL over the entire trench also capturing the channel sampling locations. The drone imagery has been georeferenced for structural mapping purposes and to precisely locate the channel samples for geological modelling.

The TRU channel sampling program included the insertion of QAQC materials (certified standards, blanks, and field duplicates) and the samples have been sent to Eastern Analytical in Springdale, NL for fire assay and ICP multi-element geochemistry analyses with results still pending. Any samples returning a fire assay result greater than 1 g/t Au will automatically trigger a total pulp metallics analysis of the sample to mitigate the presence of the nugget effect of coarse gold and to better characterize the coarse- and fine-grained gold fractions within these prominent gold bearing units.

Results from the channel sampling program at the Mark’s Pond trench will be released once all fire assay and metallic screening gold results have been received from Eastern Analytical.

Sampling, QAQC, and Analytical Procedures

All rock (grab) samples were either collected from outcrops (bedrock) or as float samples and put into sample bags with unique sample tags by TRU field staff. The exact location of the collected grab sample was taken using a handheld GPS unit and field notes were taken on lithology, structure, and mineralization. The grab samples were securely transported by TRU field staff to Eastern Analytical’s laboratory in Springdale, NL. Eastern Analytical is a commercial laboratory that is ISO/IEC 17025 accredited and independent of TRU. Eastern Analytical pulverized 1,000 grams of each sample to 95% < 89 μm. Samples are analyzed using fire assay (30g) with AA finish and an ICP-34, four acid digestion followed by ICP-OES analysis. All samples with visible gold or assaying above 1.00 g/t Au are further assayed using Total Pulp Metallic analysis (metallic screening) to mitigate the presence of the nugget effect of coarse gold.

Eastern Analytical Total Pulp Metallic Sieve Procedure: Crush entire sample to approximately 80% (-10 mesh). Total sample is pulverized to approximately 95% (-150 mesh) in 200-300g portions. Sieve all pulverized material through 150 mesh screen. The total (+150 mesh) fraction is all fire assayed as one sample and the weight recorded. The entire (-150 mesh) fraction is rolled to homogenize and stored in a plastic bag. The entire weight of the (-150 mesh) fraction is recorded. A 30g sample is fire assayed from the (-150 mesh) portion. The two fire assay results (+150 and -150 mesh) are calculated (with the total weight of the sample to provide a weighted average of the sample) and the weighted average Au result is reported.

The TRU exploration programs are designed to be consistent with mining industry best practices and the programs are supervised by Qualified Persons employing a QAQC program consistent with requirements under the CIM Mineral Exploration Best Practice Guidelines (2018) and National Instrument 43-101 (“NI 43-101”).

Cautionary Statements

Please note that soil, till, rock, and float samples are selective by nature, and values reported may not represent the true grade or style of mineralization at Golden Rose. Readers are cautioned that these potential grades are conceptual in nature; there has been insufficient exploration by the Company or its Qualified Person to define a mineral resource or deposit; and it is uncertain whether further exploration will result in these targets being delineated as a mineral resource.

The reader is cautioned that descriptions of mineralization and soil anomalies reported in this news release are preliminary and/or early-stage results. While these results are considered encouraging, there is no guarantee that they indicate significant mineralization will be intersected in future drilling programs completed by the Company.

Qualified Person Statement and Data Verification

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Mr. Ténière has verified all scientific and technical data disclosed in this news release including the grab and soil sampling results and certified analytical data underlying the technical information disclosed. Mr. Ténière noted no errors or omissions during the data verification process and TRU’s Exploration Manager has also verified the information disclosed. The Company and Mr. Ténière do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed in this news release.

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt, and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 236 km2 land package, including a recently discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

In addition, TRU has an option to acquire up to an aggregate 65% ownership interest in two large claim packages covering 33.25 km2 including a 12 km strike length along the Cape Ray - Valentine Lake Shear Zone within Golden Rose.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration plans at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose and the Company’s drilling and exploration programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Provides Exploration Update Including Additional Gold Targets at Golden Rose Project

TRU Precious Metals Corp. provides an update on additional field work being completed across several key prospective areas at its flagship Golden Rose Project in Central Newfoundland.

Toronto, Ontario – October 25, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to provide an update on additional field work being completed across several key prospective areas at its flagship Golden Rose Project in Central Newfoundland (“Golden Rose”).

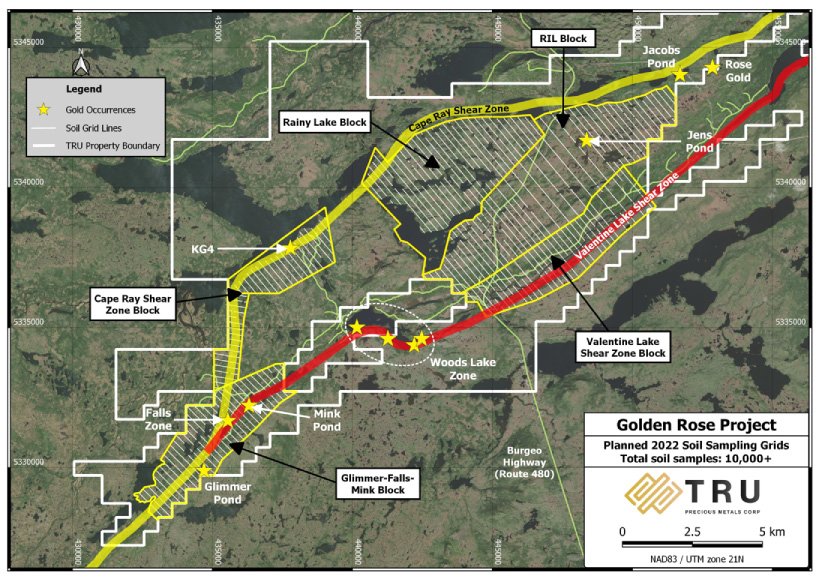

The Company is currently focused on completing trenching, soil, till, and rock sampling on the Golden Rose Project prior to the commencement of the winter season. Priority has been given to exploring highly prospective target areas based on both historical and recent exploration results and known geophysical anomalies. These areas include the Woods Lake gold zone (“Woods Lake”), Jacob’s Twin gold-copper-silver discovery area and the recently optioned Staghorn property (Figure 1).

TRU Co-Founder and CEO Joel Freudman commented: “We are pleased to be closing out the 2022 field season with additional work at Golden Rose. We have embarked on several cost-effective exploration initiatives, that allow us to protect TRU’s treasury and capitalization structure while advancing multiple targets across the project towards the drill-ready stage for a third round of drilling in 2023. We are fortunate to be adequately funded to complete this work, especially considering prevailing depressed market conditions.”

Figure 1: General location map indicating recent exploration activities at Golden Rose

Jacob’s Twin

At the Jacob’s Twin target area, a comprehensive soil sampling program was conducted in early 2022. Soil samples were collected at a 25 metre (m) spacing along 100 m spaced lines. A coincident copper-gold soil anomaly was identified 750 m to 1.2 kilometres southwest of the recently announced Jacob’s Twin gold-copper-silver discovery (please refer to TRU news release dated September 22, 2022). Based on these findings, the Company decided to conduct an additional 50 m spaced infill soil sampling program to further delineate the newly identified copper-gold soil anomaly.

Woods Lake and surrounding area

A total of 323 soil samples and 31 till samples were recently collected.

Mark’s Pond and Rich House

Trenching and prospecting work has commenced on these claims, with an immediate focus on the Mark’s Pond gold zone (“Mark’s Pond”) and Rich House gold prospect (“Rich House”) (Figure 1).

An historical trench at Mark’s Pond from 2020 is being re-opened and extended to complete channel, soil and till sampling.

Prospecting and rock sampling were recently completed at Rich House, where historical grab samples returned up to 189.2 grams per ton (g/)t gold at the main mineral occurrence, and visible gold has been previously reported.

The assay results from all the exploration programs described above are still pending from various independent laboratories and will be released by the Company in due course.

Cautionary Statements

Please note that soil, rock, and float samples are selective by nature, and values reported may not represent the true grade or style of mineralization at Golden Rose.

Any descriptions of mineralization, soil/till and IP anomalies reported in this news release are preliminary and/or early-stage results. While these features are considered encouraging, there is no guarantee that these features will return significant metal assay values if and when drilled by the Company in the future.

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Paul Ténière, M.Sc., P.Geo., Vice President of Exploration for TRU, and a Qualified Person as defined in NI 43-101.

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently, TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt, and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 269 km2 land package, including a newly discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration plans at Golden Rose and to the adequacy of the Company’s working capital. These statements are based on numerous assumptions regarding Golden Rose and the Company’s drilling and exploration programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Reinforces Team with New Vice President of Exploration

TRU announces that after a period of succession planning, Mr. Paul Ténière, P.Geo. has been appointed as Vice President of Exploration effective October 1, 2022, subject to regulatory approval by TSX Venture Exchange.

Toronto, Ontario – October 3, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF) (“TRU” or the “Company”) is pleased to announce that after a period of succession planning, Mr. Paul Ténière, P.Geo. has been appointed as Vice President of Exploration effective October 1, 2022, subject to regulatory approval by TSX Venture Exchange (“TSXV”).

Mr. Ténière will be responsible for leading exploration activities at the Company’s flagship Golden Rose Project (“Golden Rose”) in the Central Newfoundland gold belt, assuming day-to-day responsibilities from Mr. Barry Greene who has transitioned from his role as Vice President, Property Development to an advisory capacity as chair of the Company’s Technical Committee. Mr. Greene remains on the Company’s board of directors.

Mr. Ténière is a Professional Geologist with nearly 25 years of diverse experience in the mining and oil & gas sectors in Canada, United States, and internationally, taking projects from the exploration stage to mine development. He was formerly the Chief Geologist for Sherritt International Corp., and an Exploration Manager for Vale S.A. and Solid Energy New Zealand, developing large-scale coal mining projects in Alberta, Saskatchewan, Australia, and New Zealand. He has also worked on numerous carbonate-hosted Mississippi Valley Type (MVT) and SEDEX lead-zinc deposits, porphyry-style copper-lead-zinc deposits, and gold-silver-PGM deposits in Canada, United States, Latin America, Australia, New Zealand, and Europe.

Mr. Ténière has also held a variety of geological and/or corporate executive-level positions with several publicly traded junior exploration companies and was also previously Senior Listings Manager at the Toronto Stock Exchange and TSXV. He is a registered Professional Geologist (P.Geo.) in Ontario, New Brunswick, and Newfoundland and Labrador, and a Qualified Person as defined by National Instrument 43-101. He holds a Bachelor of Science (Honours) degree in Earth Sciences from Dalhousie University and a Master of Science degree in Geology from Acadia University.

TRU Co-Founder & CEO Joel Freudman commented, “We are pleased to welcome Paul to TRU to lead our exploration team and programs. Paul’s extensive and diverse experience will add considerable insight as TRU continues to build on our recent polymetallic discovery at Golden Rose. We wish to thank Barry for his efforts to date at Golden Rose, and his foundational role with TRU. Barry was instrumental to our acquisition of Golden Rose and has worked tirelessly in its development over the past two years.”

Barry Greene, Director of TRU, added: “When I agreed to join TRU, my mandate was to oversee and build out our exploration capabilities, alongside leveraging business contacts to identify and help negotiate property acquisition agreements. Having been closely involved with TRU for nearly two years, I am very pleased with the exploration progress we have made to date. I am now ceding my day-to-day responsibilities to Paul so I can move toward a founder and corporate builder career path. I remain enthusiastic about the prospects for Golden Rose, so I look forward to continuing to stay involved with TRU as a director and significant shareholder and helping Paul transition into his new role .”

Under Mr. Greene’s exploration leadership, TRU:

Acquired Golden Rose and numerous contiguous property packages, consolidating a dominant land position on a 45 kilometre (km) transect of the Cape Ray-Valentine Lake structural corridor.

Carried out infill drilling at Woods Lake Gold Zone, expanding the gold zone and identifying avenues for expansion.

Identified a 20 km splay off the Cape Ray-Valentine Lake shear zone corridor, with several prospective gold and polymetallic targets.

Identified a new copper-gold-silver prospect in its second drilling program.

The Company is also reporting the appointment, subject to TSXV regulatory approval, of Mr. Heran (Kevin) Zhou as Corporate Secretary, replacing Jo-Anne Archibald. Mr. Zhou is a finance and economics specialist and is currently a financial analyst with Resurgent Capital Corp. (“Resurgent”). Prior to joining Resurgent, he acquired work experience globally in Canada, the United States and China, serving analytical roles in private equity and asset management firms. He has sound practical experience in corporate finance, venture capital markets, and private equities. Mr. Zhou holds a B.Com. with distinction from the University of Toronto.

Mr. Freudman commented, “We thank Ms. Archibald for her dedicated efforts over the past year in enhancing our corporate governance framework. We wish her the very best in her future endeavours.”

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently, TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 266.25 km2 land package, including a newly discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to regulatory approval and the impact of additions to the TRU leadership team. These statements are based on numerous assumptions believed by management to be reasonable in the circumstances and are subject to a number of risks and uncertainties, including without limitation: challenges executing on corporate strategy and business plans; regulatory approval processes; and those other risks described in the Company's continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Opens Up New Copper-Gold-Silver Discovery at Golden Rose

TRU announces assay results from a new drill discovery at its flagship Golden Rose Project in Central Newfoundland. The 13-hole, 2,147.4 metre drilling program focused on the Jacob’s Pond area, principally the Jacob’s Twin showing, one of the five grids property-wide where the Company recently completed an extensive IP Survey.

Toronto, Ontario – September 22, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF; FSE:706) (“TRU” or the “Company”) is pleased to announce assay results from a new drill discovery at its flagship Golden Rose Project in Central Newfoundland (“Golden Rose”). The 13-hole, 2,147.4 metre (“m”) drilling program focused on the Jacob’s Pond area, principally the Jacob’s Twin showing, one of the five grids property-wide where the Company recently completed an extensive IP Survey.

Highlights

Drill intersection of multiple copper-gold-silver zones in altered conglomerate (table 1).

Last hole to intersect the discovery, JP-22-13, returned high-grade copper and silver.

Discovery remains open for expansion in multiple directions.

2022 soil sampling has defined a secondary promising target between 750m to 1.2 kilometres (“km”) southwest from the new discovery area.

Barry Greene, VP of Property Development and Director of TRU, commented: “It is always rewarding to drill under a newly discovered copper-gold bearing quartz-carbonate vein system and to upgrade it in drill core at depth. Our discovery hole, JP-22-10, and step-out hole, JP-22-13, confirms that we are in the early stage of defining an exciting new prospect with significant expansion potential. Additional step-out drilling will be required to start delineating shape, orientation and ultimately continuity of this new discovery.”

The Jacob’s Twin copper (“Cu”) -gold (“Au”) -silver (“Ag”) discovery contains multiple intervals of quartz-carbonate-sulphide veining (figures 1& 2).

The veining in hole JP-22-10 was discovered while drilling directly under a creek where a series of copper-gold bearing outcrops (see press release dated August 4, 2022) were found during 2022 summer exploration, with samples grading 1.10% to 4.19% Cu and 2.76 grams per tonne (g/t) Au. An upper mineralized zone in hole JP-22-10 from 129m to 142.3m was followed by a lower 22.6m zone from 178.4m to 201m down hole depth, containing quartz-carbonate veining and copper mineralization, the lower 3.0m interval of which assayed 1.03% Cu, 0.71g/t Au, and 24.95g/t Ag from 193.45m to 196.45m. Jacob’s Twin correlates with a high chargeability Alpha IP anomaly near the sheared contact with a flow banded rhyolite.

Follow-up drilling, in final hole JP-22-13, approximately 15m down dip of hole JP-22-10, also intersected a mineralized vein system between 187.5m-199.5m down hole depth (figure 2). The highlight of this zone assayed 1.10% Cu, 0.87 g/t Au, and 46.60 g/t Ag over 2.8m from 197 to 199.8m, including 1.14m at 2.19% Cu, 1.39g/t Au, and 108.3 g/t Ag from 198.66m to 199.8m.

TRU Co-Founder and CEO Joel Freudman added: “Drilling at Golden Rose continues to uncover the immense potential of this property, and we are barely scratching the surface. I am especially pleased with our intersect of high-grade copper, which is a critical mineral input in electric vehicles and a wide range of other ‘clean energy’ and industrial uses. With less than 7,000 metres drilled to date by TRU at Golden Rose, across two modest drill programs, we are already unveiling what we believe to be a polymetallic zone, in addition to the known gold zone elsewhere on the property. I want to acknowledge the efforts of our exploration executives, Barry Greene and Pearce Bradley, in securing the Jacob’s Pond area for TRU last year and advancing it to this new discovery zone. This is another step toward establishing that Golden Rose is geologically prospective and hosts multiple commodities, on a massive property package that has seen little to no exploration.”

Mr. Freudman continued: “Additionally, and of great significance to TRU, we are also excited that our neighbour Marathon Gold has publicly disclosed its intention to commence mine construction at the Valentine Gold Project in early 2023, becoming an operating mine producing gold by early 2025. We expect this will attract renewed interest to the Valentine Lake Shear Zone, as TRU continues to build a turnkey polymetallic project with a robust pipeline of drilling and exploration potential.”

The Company continues to await final assay results for some holes peripheral to the primary mineralized zones, which are not expected to return significant values of mineralization.

A second promising drill target is shaping up along the same structural trend approximately 750m to 1.2km to the southwest of the Jacob’s Twin target area (figure 1). This new target contains many highly anomalous Au and Cu soil anomalies in a tightly clustered grouping and along the same trend of anomalous IP chargeability. This area shows the potential for expansion of the mineralized system along a regional trend.

Figure 1 – Jacob’s Twin drilling with high priority target along trend

Figure 2 – Cu-Au-Ag discovery in quartz-carbonate-sulphide veins from DDH JP-22-10

Table 1 – Jacobs Twin Cu-Au-Ag-Target - uncut assay highlights

Figure 3 – IP chargeability zone with mineralized zones indicated

Table 2 – Jacobs Twin Collar Details

Drilling Quality Assurance/Quality Control (“QA/QC”)

All NQ core is geotechnically measured, logged and marked for sampling. The core is then cut by Company personnel, with half put into bags with unique sample tags for identification while the other half is retained for reference. CRM standards and blanks are inserted at regular intervals in the sample stream. The bags are sealed with a security tag and are then transported directly to the lab by TRU staff. Core samples are analyzed at either SGS in Burnaby B.C., or Eastern Analytical Ltd. (“Eastern Analytical”) of Springdale, NL.

Eastern Analytical is a commercial laboratory that is ISO/IEC 17025 accredited and independent of TRU. Eastern Analytical pulverized 1,000 grams of each sample to 95% < 89 μm. Samples are analyzed using fire assay (30g) with AA finish and an ICP-34, four acid digestion followed by ICP-OES analysis. All samples with visible gold or assaying above 1.00 g/t Au are further assayed using metallic screen to mitigate the presence of the nugget effect of coarse gold. Standards and blanks are inserted at defined intervals for QA/QC purposes by the Company as well as Eastern Analytical. True widths for reported intervals have yet to be determined.

SGS is a commercial laboratory that is independent of TRU. Rock and core samples are shipped to the SGS Grand Falls-Windsor Mobile Sample Prep facility where they are sorted, logged, weighed, dried at 105 C, crushed to 75% passing 2 mm, split to 250 g, and pulverized for 85% passing 75 microns. Pulps are shipped within the SGS lab network to SGS Burnaby, where they are typically tested by 30 g fire assay with AAS for gold, and aqua regia digest with ICP-AES for the 34 element package. Over limit analysis for Au is done with fire assay and gravimetric finish, and multi-elements by ore grade sodium peroxide fusion with ICP-AES.

Soil samples are sorted, logged, weighed, dried at 60 C and screened to 180 microns. Undersized material is shipped to SGS Burnaby, where samples are typically tested by 30 g fire assay with ICP-AES for gold and aqua regia digest with ICP-AES for the 34 element package.

SGS laboratories operate a Laboratory Information Management System (SLIM). The SLIM system includes method set up protocols (analytes, ranges, internal QC materials that include blanks, duplicates, replicates, and reference materials) as well as their frequency of insertion and tolerance requirements. Quality control is performed at the sample preparation stage to include % passing requirements at the crush and the pulverizing stages at set frequencies and QC samples are added to every batch of samples throughout the entire process at a frequency of ~10-15% and include preparation blanks, preparation duplicates, pulp replicates, method blanks and certified reference materials. SLIM is also used to monitor our internal processes for instruments, equipment, sample tracking, storage and reporting formats. SLIM uses a secure and complete audit trail to ensure traceability and confidentiality.

SGS Burnaby facility is accredited to the requirements of ISO/IEC 17025 for various tests listed on their scope of accreditation at https://www.scc.ca/en/search/laboratories/sgs

The TRU exploration program design is consistent with industry best practices and the program is carried out by qualified persons employing a QA/QC program consistent with National Instrument 43-101.

National Instrument 43-101 Disclaimers

Note that soil, rock and float samples are selective by nature, and values reported may not represent the true grade or style of mineralization at Golden Rose. Readers are cautioned that these potential grades are conceptual in nature; there has been insufficient exploration by the Company or its qualified person at Golden Rose to define a mineral resource or mineral reserve; and it is uncertain whether further exploration will result in these targets being delineated as a mineral resource or mineral reserve.

The reader is cautioned that descriptions of mineralization, soil anomalies and IP anomalies reported in this news release are preliminary and/or early-stage results. While these features are considered encouraging, there is no guarantee that these features will return significant gold and/or copper values when drilled.

Qualified Person

Barry Greene, P.Geo. (NL) is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF; FSE:706) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently, TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 233 km2 land package, including a newly discovered 20 km district-scale structure, and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to exploration plans at Golden Rose, and to Marathon Gold’s development plans for the Valentine Gold Project. These statements are based on numerous assumptions regarding Golden Rose and the Company’s drilling and exploration programs and results that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals prices; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Closes Option Agreement for Staghorn Project and Achieves Strategic Consolidation of Cape Ray – Valentine Lake Shear Zone

TRU Precious Metals Corp. has closed the definitive option agreement dated June 15, 2022 with Quadro Resources Ltd to acquire up to an aggregate 65% ownership in Quadro’s Staghorn Project located in central Newfoundland.

Toronto, Ontario – August 18, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF; FSE:706) (“TRU” or the “Company”) is pleased to announce that further to its news release dated June 16, 2022, it has closed the definitive option agreement dated June 15, 2022 (the "Option Agreement") with Quadro Resources Ltd. (“Quadro”).

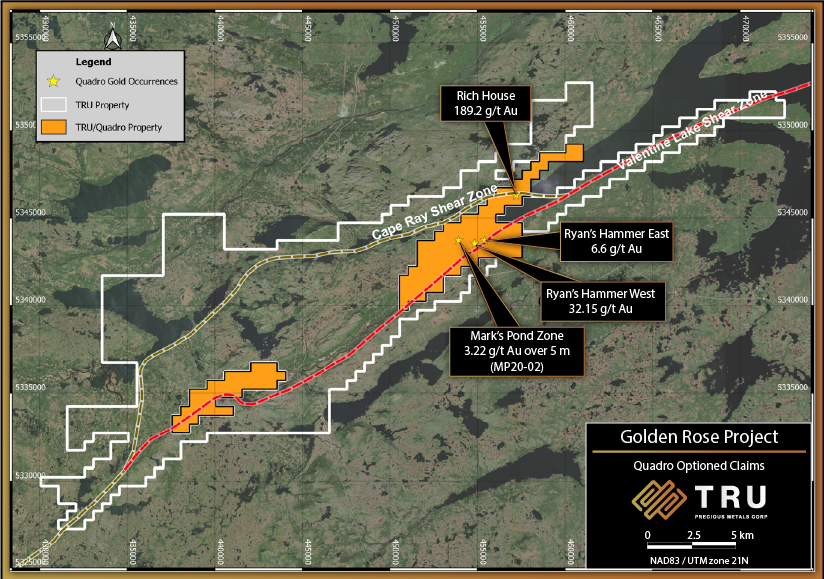

Pursuant to the terms of the Option Agreement, the Company has the option to acquire up to an aggregate 65% ownership in Quadro’s Staghorn Project (the “Staghorn Project”) located in central Newfoundland. The Staghorn Project is a large claim package of 133 claim units in eight mineral licences covering 3,325 hectares with a 12 km strike length of the auriferous Cape Ray Fault Zone. The Staghorn Project is comprised of two distinct groups of licenses (see Figure 1) which are immediately within and/or adjacent to TRU’s flagship Golden Rose Project (“Golden Rose”).

Figure 1: Staghorn Project Claims Under Option

Joel Freudman, Co-Founder and CEO of TRU commented: “This is a transformational acquisition for TRU. Since the start of 2022, we worked assiduously to add this final lynchpin to Golden Rose and have now successfully achieved our long-stated strategy of complete consolidation of the Cape Ray - Valentine Lake Shear Zone (the “CR-VL Shear Zone”) between our immediate neighbours, Marathon Gold and Matador Mining, both of whom have significant gold deposits on their properties. With this acquisition, Marathon Gold, Matador Mining and TRU are now the dominant players in control of the CR-VL Shear Zone.”

The Company has issued 1,084,171 common shares to Quadro in respect of the first share issuance due under the Option Agreement. The deemed price of such issuance shares is approximately $0.092 per share, representing the volume-weighted average trading price of TRU’s common shares on the Exchange for the 20 previous consecutive trading days. The future obligations under the Option Agreement are outlined in TRU’s news release of June 16, 2022.

All common shares issued pursuant to the terms of the Option Agreement are subject to a hold period under applicable securities laws for a period of four months plus one day from the date of issuance. For further information regarding the Option Agreement and the Staghorn Project, see the Company's news release dated June 16, 2022.

Mr. Freudman added: “Based on our internal data compiled from extensive fieldwork at Golden Rose and due diligence on the Staghorn Project, we believe that the mineralization on the latter is similar to that at Golden Rose. We continue to build out a turn-key gold and copper project at Golden Rose.”

Qualified Person and National Instrument 43-101 Disclosures

Barry Greene, P.Geo. is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF; FSE:706) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently, TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 236 km2 land package, including a newly discovered 20 km district-scale structure and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

Website: www.trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements Regarding Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information in this press release relating to Quadro and the Staghorn Project has been compiled from publicly available sources and has not been independently verified by TRU.

This press release contains certain forward-looking statements, including those relating to the Option Agreement transaction and acquiring and exploring the Staghorn Project. These statements are based on numerous assumptions regarding the Option Agreement transaction with Quadro that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Staghorn Project and/or Golden Rose; the exploration potential of the Staghorn Project and/or Golden Rose; challenges in identifying, structuring, and executing transactions on favourable terms or at all; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; regulatory approval processes; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Options Out its Twilite Gold Project to Eastern Precious Metals

TRU has entered into an option agreement with Eastern Precious Metals Corp., pursuant to which Eastern has been granted the option to acquire a 100% interest in the Company’s Twilite Gold Project located in the Central Newfoundland Gold Belt. The Project consists of 65 claims covering 16.25 square kilometres located along the deposit-bearing Cape Ray - Valentine Lake structural corridor.

Toronto, Ontario – August 16, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF; FSE:706) (“TRU” or the “Company”) is pleased to announce that it has entered into an option agreement (the “Agreement”) with Eastern Precious Metals Corp. (“Eastern”), pursuant to which Eastern has been granted the option to acquire a 100% interest in the Company’s Twilite Gold Project (“Twilite Gold” or the “Project”) located in the Central Newfoundland Gold Belt. The Project consists of 65 claims covering 16.25 square kilometres located along the deposit-bearing Cape Ray - Valentine Lake structural corridor.

Agreement Highlights:

Eastern can earn a 100% interest in the Project;

TRU would receive up to 2,500,000 common shares of Eastern (“Shares”) within 100 days of the Effective Date (as defined below), such Shares to have a deemed issue price per Share equal to $0.10 (the “Initial Shares”). A portion of the Initial Shares received will be distributed to TRU shareholders;

Within three years of the Listing Date (as defined below), TRU would receive an additional number of Eastern Shares worth $150,000; and

Eastern would fund a minimum of $450,000 in exploration expenditures at the Project over a three-year period.

TRU Co-Founder & CEO Joel Freudman commented, “We are pleased that we are starting to deliver on our previously announced corporate strategic objectives that support our exploration efforts, as we disclosed on June 2, 2022. This transaction monetizes an asset currently under-utilized by TRU, and will strengthen TRU’s balance sheet while yielding a direct benefit to TRU’s shareholders. Most importantly, this allows TRU to focus on our flagship Golden Rose Project, where we recently announced a 2,000-metre diamond drill program.”

“We are very excited to have signed an option agreement to acquire the Twilite Gold Project in Central Newfoundland,” stated Aaron Eisenberg, CEO of Eastern. “We look forward to building upon TRU's initial exploration program to further expand on their findings.”

Details about prior work completed at Twilite Gold, by TRU, including a Phase 1 diamond drilling program, are available in the Company’s news releases dated October 8, 2021, September 15, 2021 and August 18, 2021.

Terms of the Agreement

In order to acquire the 100% interest in the Project, Eastern must issue to TRU the number of common shares in the capital of Eastern and must fund a minimum of $450,000 in exploration expenditures as follows:

The Company has agreed to engage a Qualified Person, as defined in NI 43-101, to author and produce an NI 43-101 technical report on the Project (the “Technical Report”) at the sole cost of Eastern. There are certain anti-dilution rights and penalty provisions in the Company’s favour which apply prior to Eastern’s listing.

If Eastern does not list its common shares on a Canadian stock exchange within seven months from the Effective Date, the Company will be issued 1,000,000 additional Shares at a deemed price of $0.10 per share for no additional consideration.

Closer to the Listing Date, the Company intends to distribute approximately 63% of the Initial Shares to the shareholders of TRU as a dividend or other distribution. The Company expects that the Initial Shares being distributed to TRU shareholders will be free trading on Eastern’s listing on a recognized Canadian stock exchange, with the balance of the Shares held by TRU subject to voluntary share resale restrictions staggered over a 9-month period starting on the Listing Date.

In accordance with the Agreement, the Project is subject to a 4-kilometre area of influence, within which any claims acquired by Eastern or TRU during the Agreement term shall be deemed to form part of the Project. Should Eastern not exercise its option under the Agreement, 100% of the Project will revert to TRU. Throughout, and exclusively limited to, the term of the Agreement, Eastern shall be the exclusive operator with overall responsibility for the operations of the Project.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF; FSE:706) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 236 km2 land package, including a newly discovered 20 km district-scale structure and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.

TRU is a portfolio company of Resurgent Capital Corp. (“Resurgent”), a merchant bank providing venture capital markets advisory services and proprietary financing. Resurgent works with promising public and pre-public micro-capitalization companies listing on Canadian stock exchanges. For more information on Resurgent and its portfolio companies, please visit Resurgent’s website at https://www.resurgentcapital.ca/ or follow Resurgent on LinkedIn at https://ca.linkedin.com/company/resurgent-capital-corp.

About Eastern Precious Metals Corp.

Eastern Precious Metals is a mineral exploration company, that will be focused on exploring for gold and other minerals at the Twilite Gold Project in the Central Newfoundland Gold Belt. From time to time, the Company may also evaluate the acquisition of other mineral exploration assets and opportunities.

For further information about TRU, please contact:

Joel Freudman

Co-Founder & CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

For further information about Eastern, please contact:

Aaron Eisenberg

CEO & Director

Eastern Precious Metals Corp.

Phone: +1 (416) 270-5459

Email: aeisenberg@plazacapital.ca

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for its past financial support through the Junior Exploration Assistance Program.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain forward-looking statements, including those relating to the Agreement and the re-distribution of the Initial Shares. These statements are based on numerous assumptions regarding Twilite Gold, the Agreement, and the Shares, that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: whether the terms of the Agreement will be fulfilled in whole or in part, and whether the option granted by the Agreement will be exercised; challenges in identifying, structuring, and executing transactions on favourable terms or at all; tax and regulatory risks relating to distribution of the Shares; risks inherent in mineral exploration activities; volatility in financial markets, economic conditions, and precious metals prices; and those other risks described in the Company's continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

TRU Announces 2,000 Metre Drill Program at the Jacob’s Pond area of the Golden Rose Project

TRU Precious Metals Corp. announces an approximately 2,000 metre (m) diamond drill program at the Company’s flagship Golden Rose Project located in the Central Newfoundland gold belt.

Toronto, Ontario – August 4, 2022 – TRU Precious Metals Corp. (TSXV:TRU; OTCQB:TRUIF; FSE:706) (“TRU” or the “Company”) is pleased to announce that an approximately 2,000 metre (m) diamond drill program is underway at the Company’s flagship Golden Rose Project (“Golden Rose’’) located in the Central Newfoundland gold belt. The drilling will focus on the Jacob’s Pond area, where the Company recently completed an extensive IP Survey to determine high-priority areas and targets.

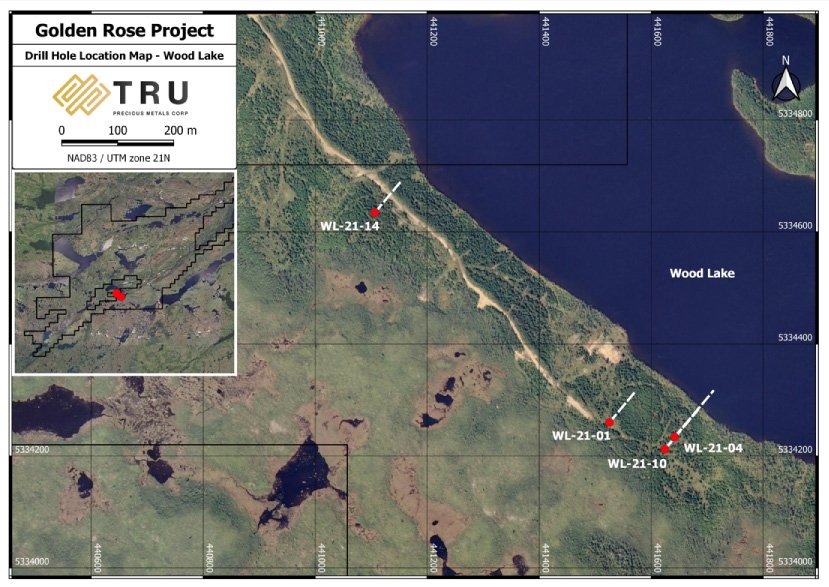

Drilling has commenced with a plan to complete approximately 10-12 diamond drill holes. The two key target areas dubbed Jacob’s Main and Jacob’s Twin (Figure 1) will form the basis of this initial drilling. These areas have never been drilled before.

Drill Targets Rationale

Mineralization can be directly correlated with the base of an extensive IP geophysical anomaly.

Identification of approximately 75m section of creek bed containing numerous copper-gold (Cu-Au) bearing quartz veins and brittle fractures hosted by conglomerate. True thickness of the mineralized zone is estimated at approximately 15-20m based on intermittent outcrops.

Summer 2022 grab sampling results include 6 out of 21 samples grading from 1.10% Cu to 4.19% Cu including one sample grading 3.42% Cu and 2.76 grams per tonne (g/t) Au. (Figure 2)

Conglomerate host rocks also contain frequent secondary copper rich (malachite) blebs after primary chalcocite/bornite. Mineralization occurs within and near the sheared contact between conglomerate and rhyolite

Barry Greene, VP of Property Development and Director of TRU, commented: “We have been diligently completing geochemical, geological and geophysical surveys over the past year and now feel ready to test a number of these targets where our combined data is leading us. Given the location of these targets along the Cape Ray-Valentine Lake structural corridor, which hosts proven gold deposits on adjacent claims, we are delighted to have broken ground.”

Figure 1 – Two Key Target Drilling Areas – Jacob’s Main and Jacob’s Twin

Figure 2 – 2022 Jacob’s Twin IP Chargeability Anomaly and Rock Samples

About Jacob’s Pond

The Jacob’s Main and Jacob’s Twin areas contains numerous coincident geological/geochemical/geophysical anomalies over approximately four kilometers of extent, which forms part of the 20 km structural trend on the northwest side of Golden Rose. Only a small selection of these potential anomalies will be targeted during this drill campaign.

During TRU’s summer 2022 field program, while ground truthing a copper-gold-silver soil anomaly with coincident IP anomaly on the Jacob’s Twin area, TRU’s geological team was excited to identify a heavily mineralized section of a natural stream bed. This bedrock mineralized zone is located within 75m of the highest-grade sample collected by TRU in 2021. The 2021 sample of very angular quartz vein float material contains bornite and chalcocite and graded 14.3 g/t Au, 368.0 g/t silver (Ag), and 11.0% Cu. Additionally, several new occurrences of similar mineralized angular float material have been unearthed. The 75m section of creek bed contains several quartz vein swarms which contain variable thickness of vein material up to about 2m thickness. The veins, hosted by a polylithic conglomerate, contain brittle fractures that have been infilled by common copper minerals including bornite, chalcocite and chalcopyrite. Additionally, the sheared conglomerate contains highly flattened clasts, some of which appear to be sulphide clasts with malachite coating the dull grey sulphide. This sulphide is believed to be chalcocite. Samples have been selected for polished section for positive identification of minerals and to assist with understanding the timing of mineralization. Several drill holes are proposed to evaluate this mineralized zone, which plots on the base of a very strong IP anomaly that continues for many hundreds of metres. To date, bedrock sampling along trend/strike of this creek has uncovered copper mineralization associated with conglomerate over approximately 200m.

This drill program is anticipated to take approximately 4 weeks to complete, and results will be released in batches in the early fall.

Shareholder Meeting Results

The Company is also reporting voting results from the Annual & Special meeting held on July 21, 2022. Shareholders approved all items of business, including electing each of the directors nominated by management, namely, Joel Freudman, Barry Greene, Damian Lopez, Colin Sutherland and David Hladky. The shareholders also approved: the reappointment of McGovern Hurley LLP, Chartered Professional Accountants, as auditors of the Company for the ensuing year; the Company’s amended stock option plan; and a potential corporate name change. The Company amended its stock option plan to align with the TSX Venture Exchange’s recently amended Policy 4.4 Security Based Compensation. A copy of the stock option plan was included in the Information Circular which has been filed on SEDAR.

Qualified Person

Barry Greene, P.Geo. (NL) is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this press release. Mr. Greene is a director and officer of the Company and owns securities of the Company.

About TRU Precious Metals Corp.

TRU (TSXV:TRU; OTCQB:TRUIF; FSE:706) is on a mission to build long-term shareholder value, through prudent natural resource property development and transactions. Currently TRU is exploring for gold and copper in the highly prospective Central Newfoundland Gold Belt and has an option with TSX-listed Altius Minerals to purchase 100% of the Golden Rose Project. Golden Rose is a regional-scale 236 km2 land package, including a newly discovered 20 km district-scale structure and an additional 45 km of strike length along the deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Marathon Gold’s Valentine Gold Project and Matador Mining’s Cape Ray Gold Project.