TRU NEWS

All disclosure filings, including news releases and financial documents can be found on the TRU Precious Metals SEDAR page.

TRU REPORTS ON RESULTS FROM 2025 DRILLING PROGRAM INTERSECTING GOLD-BEARING MINERALIZATION IN EVERY HOLE

TRU is pleased to provide the results from its 2025 diamond drilling program consisting of 1,988 meters in a total of four holes on its Golden Rose Project.

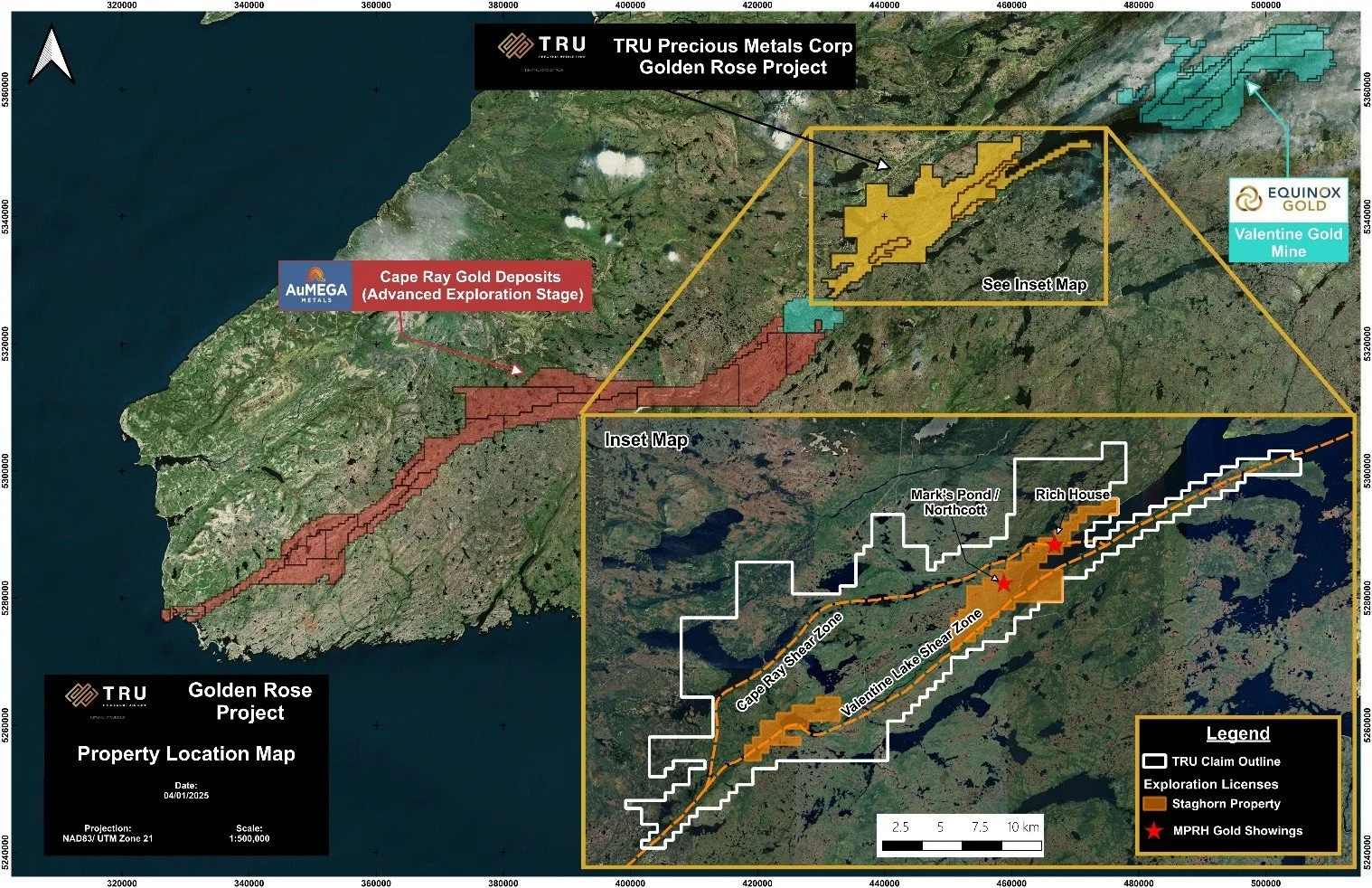

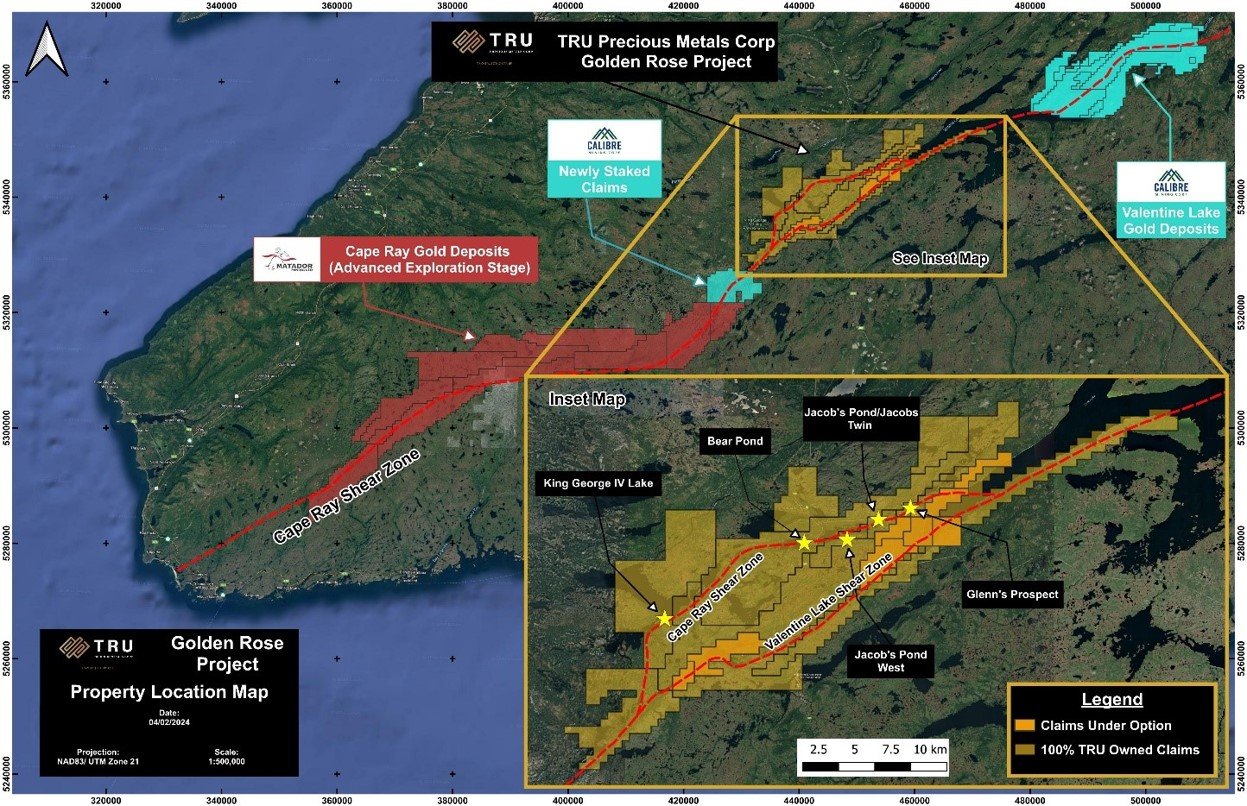

Toronto, Ontario – September 10, 2025 – TRU Precious Metals Corp. (TSXV:TRU, FSE:706) (“TRU” or the “Company”) is pleased to provide the results from its 2025 diamond drilling program consisting of 1,988 meters (“m”) in a total of four holes on its Golden Rose Project (“Golden Rose”). (See Figure 1)

Highlights

The investigative, wide-spaced, four-hole, (1,988m) diamond drilling program intersected gold-bearing mineralization in every hole

A previously unknown broad mineralized sandstone unit was intersected in two of the drill holes (GR 25-03 and GR 25-04) over an interpreted minimum strike length of 500m. Assay results from this mineralized sandstone are:

1.0 grams per tonne (“g/t”) gold (“Au”) over 13.3m including 1.3g/t over 5.3m, within a much wider interval of 0.3g/t over 65.3m in GR 25-03

1.0g/t Au over 5.1m within a wider interval of 0.5g/t over 18.2m in GR 25-04

A second previously unknown mineralized zone displaying similarities to the above-mentioned mineralized sandstone, and which may represent an along strike extension of the same zone, was intersected in drill hole GR 25-02 providing an intercept of 1.0g/t Au over 4.0m

Indications of continuity of the previously trenched Northcott zone were identified over 240m vertically at depth in drill hole GR 25-01

Reported intervals are length-weighted down-hole. True widths of reported mineralized intervals, as a percentage of down-hole intervals, are estimated to be between 60% and 80%. Sample length varied between 1.5m maximum and 1.0m minimum, except where smaller sample lengths were required for geological reasons. No grade capping applied.

TRU CEO Steve Nicol commented: “I am very pleased to be reporting upon the results achieved in our investigative 2025 drilling program which exceeded expectations with all 4 holes intersecting gold-bearing mineralization. We are very encouraged by the positive first test of the potential vertical continuity of the Northcott mineralization typified by high grades over narrow widths at surface from the 2023 trenching(1), and especially by the discovery of two previously unknown gold mineralized zones, one of which is approximately 1.6 kilometers to the southwest of Mark’s Pond with an interpreted strike length in excess of 500m and favourable initial intercepts within broad lower grade envelopes. The significance of these results continues to be assessed together with ongoing results from the mapping and ground truthing programs currently underway across the Golden Rose Project area all feeding into the design of future follow-up drilling programs.”

(1) For further information see the Company’s news release dated Jan 12, 2023

2025 Drilling Program Results

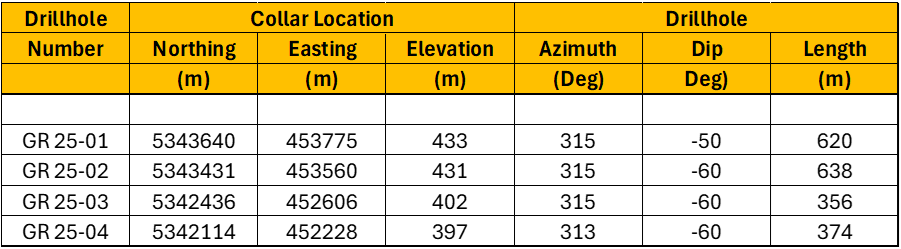

Details of the 4 completed drill holes comprising the drilling program are as follows

Table 1 – Details of completed drill holes

The following map shows the locations of the 4 drillholes

Figure 1 - Location of 2025 drilling

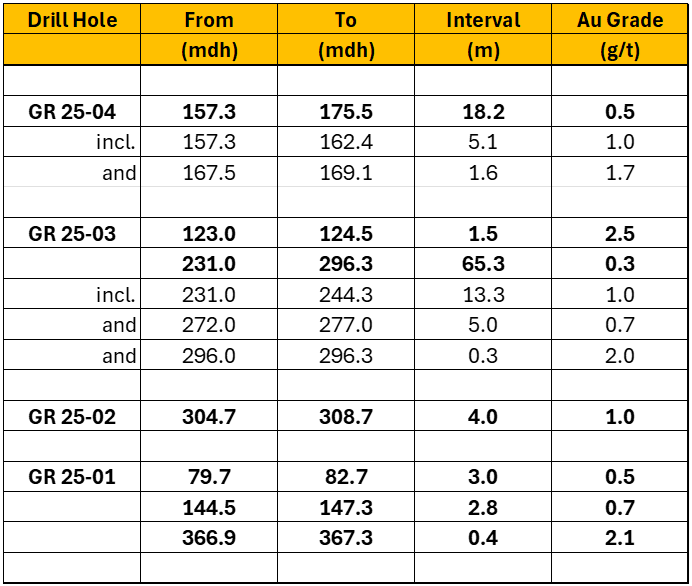

A full set of the length weighted intercepts received is provided in the following table.

Table 2 – Length weighted drill hole intercepts

All drilling was carried out to recover NQ size diamond core.

Table provides down hole lengths. True widths of reported mineralized intervals, as a percentage of down-hole intervals, are estimated to be between 60% and 80%.

There were no known drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to in this news release.

Discussion of Results

Aims of the drilling included:

Complying with the contractual drilling expenditure commitments under the Option Agreement between Quadro Resources Ltd. and TRU concerning the Staghorn property in Newfoundland and Labrador (“Staghorn”), as amended (the “Option Agreement”)

Infilling a 200m gap in past drilling near the historic southwest extent of drilling on the mineralized zone at Mark’s Pond

Exploring potential for down dip continuity of the mineralized zone at Northcott

Exploring the prospectivity of the intervening sequence of lithology between the Mark’s Pond and Northcott mineralized zones – a horizontal distance of some 200m.

Exploring the prospectivity of a potential repeat of the Mark’s Pond zone some 1.6 kilometers (“km”) further to the southwest.

The target area for the 2025 drilling program was focused upon a portion of the Mark’s Pond to Rich House “exploration fairway.” (see the Company’s news release dated April 03, 2025) based upon its interpreted prospectivity and the necessity to comply with certain drilling commitments pursuant to the terms of the Option Agreement. The Staghorn licenses comprise part of the exploration fairway and represent approximately 11% of the total Golden Rose licenses area. (see the Company’s news releases dated June 16, 2022 and August 18, 2022). Satisfactory completion of the 2025 drill program enabled TRU to exercise its option to acquire a 51% interest in the Staghorn property. (See the Company’s news release dated July 10, 2025)

Geological Results (See Figures 2 and 3)

Drillholes GR 25-03 and GR 25-04 were both drilled with the aim of testing a coincident soil and magnetic anomaly located to the southwest of Mark’s Pond which is similar to that which vectored to the original Mark’s Pond discovery in 2018 (see Quadro Resources Ltd. New Release dated November 06, 2018). GR 25-03 was collared some 1.6km southwest of Mark’s Pond, with GR 25-04 being collard a further 500m to the southwest beyond GR 25-03. Whilst not intersecting mineralization similar to the Mark’s Pond mineralization, both drillholes intersected a wide zone of gold-bearing mineralization hosted in a pale green to grey fine grained tuffaceous sandstone unit containing pyrite, arsenopyrite, and galena, which has not been previously encountered at Golden Rose. Both drillholes provided 1.0g/t Au intercepts over widths of 13.3m and 5.1m respectively, each contained within much larger lower grade envelope of 0.3g/t over 65.3m, and 0.5g/t over 18.2m, respectively. Correlation across the two drillholes is positive suggesting a minimum 500m extension of this previously unknown mineralization which is open in all directions.

Drillhole GR 25-01 was targeted to infill a gap of some 200m in historic drilling in the Mark’s Pond zone. The hole encountered two intercepts (0.5g/t Au over 3.0 m from 79.7m downhole, and 0.7g/t Au over 2.8m from 144.5m) which are interpreted to indicate the potential for the mineralization at Mark’s Pond to continue to the southwest.

GR 25-01 was then extended to provide an initial test of the down dip continuity of the Northcott mineralized zone, as well as a drill test on the intervening lithology. Northcott lies some 200m to the northwest of the Mark’s Pond zone and was discovered by TRU in 2023 (see the Company’s news release dated January 12, 2023) during surface trenching in the area. Northcott provided several bonanza grade intercepts across approximately 2.0m of quartz veining in the trenching, including considerable visible gold. GR 25-01 is interpreted to have intersected the down dip extension of the Northcott mineralized zone at a vertical depth of some 240m (367m downhole) providing an intercept of 2.1g/t over 0.4m. Whilst not replicating the bonanza grades seen in parts of the trench, this result points to a significant downdip potential for the zone which remains open at depth.

GR 25-02 was designed with similar aims to GR 25-01 and represented a parallel step-out drill hole collared some 300m to the southwest of GR 25-01. While GR 25-02 did not intersect gold grade corresponding to the projected position of either the Mark’s Pond or Northcott mineralized zones, it did intercept (1.0g/t Au over 4.0m) hosted in a lithological unit displaying similarities to the sandstone unit hosting the mineralized zone intersected in GR 25-03 and GR 25-04 located approximately a kilometer to the southwest. Additional work is required to understand if the mineralized unit intercepted in GR 25-02 represents an extension of the same zone discovered in GR 25-03 and GR 25-04, or whether it is a similar though parallel additional mineralized zone.

Figure 2 -Main 2025 drilling intercepts obtained and mineralized zones

Figure 3 - 2025 drill program showing scale of drilling area and mineralized zones

TRU geologists and advisors will be assessing all the results achieved in the 2025 drilling program, and their implications for prioritisation of targets for future drill programs.

In parallel, the TRU exploration team remains in the field for the rest of the 2025 field season advancing mapping and ground truthing programs across the entire project area with the objective of further refining the geological and structural site-wide model and adding to the expanding pipeline of quality drill targets.

Quality Assurance - Quality Control ("QA/QC")

During all exploration sampling and analysis works on its Golden Rose Project, TRU maintains a strict quality assurance program, implements a quality control program, and has a sample security procedure in place. These are tailored as necessary to be appropriate to the types of samples being collected.

Samples reported on in this news release comprised half (cut) NQ diamond drill core.

All the NQ core recovered during the 2025 drilling program was delivered on a shift-by-shift basis by the drilling contractor to the core processing area purpose built by TRU onsite at Golden Rose. All core was orientated, photographed, detail logged, and delineated for sampling by TRU geological team. Core was subsequently halved by a diamond-bladed core saw operated by TRU geological team, with one half of the core then being sampled and bagged (in accordance with in-house procedures) for sending to the laboratory for analysis. The remaining half of the core was stored for future reference or use.

Half core samples, each with a unique sample identification, were individually sealed inside tie-locked plastic bags which were packed into rice sacks which were also tie-locked. The rice sacks were packed onto wooden shipping pallets with the pallet load being plastic wrapped ready for dispatch. All this was carried out by TRU geological team at the core processing area under the direct supervision of Joel Cranford, TRU’s Qualified Person.

All the above steps, including selection of half core for analysis, were conducted in accordance with TRU in-house written Standard Operating Procedures for Core Handling, Core Photography, Core Logging, Core Cutting, and Core Sampling.

QA/QC samples, including blanks and certified standards were inserted into the sample runs prior to samples being loaded into rice sacks, in accordance with TRU Standard Operating Procedure for QAQC sample selection and insertion. Insertion rates for blanks and certified standards were approximately 5% (each) of all samples submitted for assay. Field duplicates were also used.

The plastic wrapped rice sacks on pallets were loaded onto a contractor flat-tray truck for transport directly from the Golden Rose site to the shipping agent in Corner Brook, who shipped the pallets directly to the ALS Laboratory in Moncton, NB.

Chemical analysis of core samples was carried out at ALS laboratories in Moncton NB (17 Somers Dr, Moncton, NB E1H 2P3) a commercial geoscience laboratory that is ISO/IEC 17025 accredited and completely independent of TRU.

Samples were analyzed using a 4 acid digestion with Inductively Coupled Plasma Mass Spectrometry (ICP MS) finish (25g) for a full suite of elements plus fire assay (30g) with Atomic Absorption Spectrometry (AAS) finish for gold values.

Samples returning assayed values in excess of 10g/t Au were to be re-assayed using fire assay with Gravimetric finish (30g), however, no such samples were encountered.

Re-assaying (by screened fire assay, fire assay with gravimetric finish or other appropriate method) of two samples with logged visible gold is yet to be undertaken.

Data Verification Statement

Prof. G. Earls, EurGeol PGeo, FSEG, an independent Qualified Person under National Instrument 43-101 – Standards of Disclosure in Mineral Projects (“NI 43-101 Standards”)) has independently checked and verified the data disclosed including sampling, analytical, and test data underlying the information or opinions contained in this news release.

Data verification included:

Review of all Standard Operating Procedures

Batch checking of analytical data to ensure no input or translation errors

Check calculation of all intercepts reported

Visual inspection of all mineralized intercepts recovered during the drilling program.

Review of logging and photographic databases to confirm validity of intercepts reported

Detailed review of all QA/QC results

No material flaws were detected during the data verification exercise.

Qualified Person Disclosure

Joel Cranford, P.Geo., Project Geologist for TRU, and a Qualified Person under NI 43-101, has prepared or supervised the preparation of the scientific and technical information contained in this news release and has approved its disclosure.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has a 51% interest) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Equinox Gold Corp’s Valentine Project and AuMEGA Metals Ltd’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an earn-in agreement (the “Earn-In Agreement”) with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to the Company’s July 30th, 2024 press release for further details of the Earn-In Agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve Nicol

Chief Executive Officer

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward Looking Information

This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such statements include, but are not limited to, statements regarding the interpretation of drill results, potential strike and width continuity, planned exploration programs and their timing, the significance of drilling results, the assessment of results for future drill program design, the continuation of mapping and ground truthing programs, the potential for down dip continuity of mineralized zones, the expansion of drill target pipelines, and the Company's exploration objectives and business plans. Forward-looking statements are based on assumptions, estimates, opinions and analysis made by management in light of its experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances. These assumptions include, among other things, continuity of geological structures and grade along strike and at depth, the availability of exploration financing, timely receipt of permits, access to equipment and personnel, the successful completion of ongoing exploration programs, the ability to advance quality drill targets, continued access to the Golden Rose Project site, and stable commodity prices.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements, or developments to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: the speculative nature of mineral exploration and development; uncertainty in the interpretation of drill results and geological data; environmental, permitting and regulatory risks; operational risks inherent in exploration activities; changes in commodity prices and market conditions; competition for mineral properties and qualified personnel; weather and seasonal access limitations; equipment availability and operational delays; currency fluctuations; and other risks detailed from time to time in the Company's filings with Canadian securities regulatory authorities.

Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that they will prove to be correct. TRU undertakes no obligation to update any forward-looking statements except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU OPTIONS OUT TWILITE GOLD PROJECT TO COPPERHEAD RESOURCES INC.

TRU has entered into an option agreement with Copperhead Resources Inc., pursuant to which the Company has granted the exclusive option to earn a 100% ownership interest in the Company’s Twilite Gold Project which consists of 65 claims covering 1,625 hectares located in the Central Newfoundland Gold Belt.

Toronto, Ontario – August 19, 2025 – TRU Precious Metals Corp. (TSXV:TRU; FSE:706) (“TRU” or the “Company”) is pleased to announce that it has entered into an option agreement (the “Agreement”) with Copperhead Resources Inc. (“Copperhead”), pursuant to which the Company has granted the exclusive option to earn a 100% ownership interest in the Company’s Twilite Gold Project (“Twilite” or “Property”) which consists of 65 claims covering 1,625 hectares located in the Central Newfoundland Gold Belt.

Terms of the Agreement

In order to exercise its option to acquire a 100% interest in Twilite, Copperhead must make cash payments and exploration expenditures, and must issue common shares of Copperhead (“Shares”) as set out below:

pay $25,000 in cash to TRU on August 18, 2025 (paid);

on or before August 18, 2027, incur exploration expenditures of an aggregate of $75,000 plus applicable taxes on the Property; and

on or before August 18, 2027: (i) pay additional $200,000 in cash to TRU; and (ii) issue such number of Shares of Copperhead to TRU as is equal in value to $300,000, at a deemed price per Share equal to the closing price of the Shares of Copperhead on the Canadian Securities Exchange on the day immediately prior to the Share issuance.

Upon exercise of the option, Copperhead will grant TRU a 2.0% net smelter returns (“NSR”) royalty from any future mineral production at Twilite.

Throughout the terms of the Agreement, Copperhead shall have overall responsibility for the operations on the Property. All work on the Property in connection with the exploration expenditures shall be carried out by TRU at Copperhead’s direction and at market rates.

TRU CEO Steve Nicol stated: “We are pleased to be entering into this option agreement on the Twilite Project with Copperhead, which we see as continuing our stated aim of remaining focussed upon efficiently discovering the full gold and copper potential of our flagship Golden Rose Project. Monetizing an asset which is not currently the focus of exploration activities by the Company, strengthens the Company’s financial position whilst still enabling the Twilite Project to be advanced.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has a 51% interest) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Equinox Gold Corp’s Valentine Project and AuMEGA Metals Ltd’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to our July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to completing the transactions contemplated by the Option Agreement and exploration potential of the Twilite Project. These statements are based on numerous assumptions regarding the Option Agreement and future corporate plans that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: the Option may never be exercised by Copperhead as proposed or at all; the exploration potential of the Twilite Project; risks inherent in mineral exploration activities; regulatory approval processes; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU ELECTS TO MAINTAIN A 51% INTEREST IN STAGHORN PROPERTY

TRU Precious Metals Corp. has opted not to exercise the Additional Option that would have seen the Company acquire an additional 14% interest in the Staghorn Property.

Toronto, Ontario – August 6, 2025 – TRU Precious Metals Corp. (TSXV:TRU, FSE:706) (“TRU” or the “Company”) wishes to announce that it has opted not to exercise the Additional Option that would have seen the Company acquire an additional 14% interest in the Staghorn Property. As such, TRU and Quadro Resources Ltd. (“Quadro”) are now deemed to have entered into a 51%/49% Joint Venture Arrangement on the Staghorn Property.

On July 10, 2025 TRU announced that it had formally exercised the Initial Option to acquire a 51% interest in the Staghorn Property pursuant to an option agreement between TRU and Quadro dated June 15, 2022, as subsequently amended (the “Option Agreement”). Section 3.3 of the Option Agreement provided TRU with a 30-day period during which it could provide written notice of its intention to exercise the Additional Option enabling it to acquire an additional 14% interest in the Staghorn Property. The Company has decided not to avail itself of this right to exercise the Additional Option accordingly, the parties will now commence negotiations aimed at finalising the terms of the Joint Venture Agreement (“JVA”) that will regulate the new arrangement between the parties. The JVA will contain normal industry standard terms and other terms broadly set out in the Option Agreement.

Exercising the Additional Option would have seen TRU obliged to pay $200,000 cash to Quadro, and incur $850,000 of exploration expenditures, including $510,000 of drilling activity on the Staghorn Property, within two years of having exercised the Initial Option.

TRU CEO Steve Nicol commented: “The decision not to exercise the Additional Option on the Staghorn Licenses, which cover approximately 11% of the total project area of Golden Rose, is in line with our stated aim of taking a “big picture” perspective of the entire consolidated land package. Exercising the Additional Option would have resulted in restrictions being placed upon where exploration dollars could have been spent in the next 2 years, and this was not considered the most efficient manner to advance our efforts aimed at discovering the full gold and copper potential that may exist within Golden Rose.

The TRU exploration team is now back out in the field advancing the mapping and ground truthing programs across the entire project area aimed at further refining the geological and structural site-wide model and expanding the pipeline of quality drill targets. Assay results from out drilling program completed earlier this season are now being received and will be reported upon when they have been compiled and assessed.”

About TRU Precious Metals Corp.

TRU (TSXV:TRU, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has a 51% interest) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Equinox Gold Corp’s Valentine Project and AuMEGA Metals Ltd’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to our July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU EXERCISES INITIAL OPTION TO ACQUIRE 51% INTEREST IN STAGHORN PROPERTY

TRU Precious Metals Corp. has formally exercised the Initial Option to acquire a 51% interest in the Staghorn Property pursuant to an option agreement between TRU and Quadro Resources Ltd. dated June 15, 2022 as subsequently amended.

Toronto, Ontario – July 10, 2025 – TRU Precious Metals Corp. (TSXV:TRU, FSE:706) (“TRU” or the “Company”) is pleased to announce that it has formally exercised the Initial Option to acquire a 51% interest in the Staghorn Property pursuant to an option agreement between TRU and Quadro Resources Ltd. (“Quadro”) dated June 15, 2022 as subsequently amended (the “Option Agreement”). The Company satisfied all of the requirements set forth in the Option Agreement for the Initial Option, including the completion of a minimum expenditure drill program. (see News Release June 16, 2022 and August 18, 2022). The Staghorn licenses represent approximately 11% of the total Golden Rose Project (“Golden Rose”) licenses area strategically located along the gold deposit bearing Cape Ray – Valentine Lake Shear Zones in Central Newfoundland.

Pursuant to Section 3.3 of the Option Agreement, upon exercising the Initial Option, TRU has a 30-day period during which it can provide written notice of its intention to exercise the Additional Option which would enable TRU to acquire an additional 14% interest in the Staghorn Property. The exercise of the Additional Option would require the Company to pay $200,000 cash and incur $850,000 of exploration expenditures, including $510,000 of drilling activity on the Staghorn Property, within two years of exercising the Initial Option.

The Company also announces that it has completed a 1,988 metre diamond drill program at its Golden Rose Golden Rose Project (“Golden Rose”). The 2025 drilling program was focused upon a portion of the Mark’s Pond to Rich House “exploration fairway” (see News Release dated April 03, 2025) which was selected based upon its interpreted prospectivity, and to comply with the minimum expenditure drilling commitments, as a portion of the Staghorn Property is located within the exploration fairway. (see Figure 1)

Assay results from the drill program are still pending and will be reported upon when received.

In the meantime, the Company’s field crew will be following up with a focused mapping and ground truthing program aimed at further refining the geological and structural site-wide model and expanding the pipeline of quality drill targets beyond the initial area of drilling focus.

Figure 1: Initial Exploration Fairway at Golden Rose

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has a 51% interest and an option with TSX-listed Quadro Resources Ltd. to acquire an additional 14% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Equinox Gold’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to the July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU UPDATES US EXCHANGE LISTING

TRU announces that it will voluntarily delist from the OTC Markets Group OTCQB Venture market effective May 31, 2025.

Toronto, Ontario – May 30, 2025 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) announces that it will voluntarily delist from the OTC Markets Group OTCQB Venture market (“OTCQB”) effective May 31, 2025. Beginning on June 1, 2025, the Company’s common shares will be quoted in the US on the OTC Pink Current Market (“OTC”), also operated by the OTC Markets Group.

TRU CEO Steve Nicol commented: “This voluntary delisting is part of our ongoing cost-rationalization effort aimed at maximizing the allocation of funds towards exploration activities to create value for our shareholders.”

TRU’s shares will continue to trade in Canada on the TSX Venture Exchange under the current ticker symbol “TRU,” and will be quoted in the US on the OTC under the current ticker symbol “TRUIF”.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to our July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU Announces Commencement of Drilling at Golden Rose

TRU is pleased to report that drilling has commenced on an approximate 1,800 metres 2025 diamond drilling program at the Golden Rose Project.

Toronto, Ontario – May 6, 2025 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) is pleased to report that drilling has commenced on an approximate 1,800 metres 2025 diamond drilling program at the Golden Rose Project (“Golden Rose”). Golden Rose is strategically located along the gold deposit bearing Cape Ray – Valentine Lake Shear Zones in Central Newfoundland.

The target area for the 2025 drilling program is focused upon a portion of the Mark’s Pond to Rich House “exploration fairway.” (see News Release dated April 03, 2025). This exploration fairway was selected for the 2025 drill program based upon its interpreted prospectivity and to comply with certain drilling commitments required prior to early July 2025 pursuant to the terms of the Option Agreement with Quadro Resources, as modified, on the Staghorn licenses, which comprise part of the exploration fairway. (see News Releases dated June 16, 2022 and August 18, 2022). The Staghorn licenses represent less than 12% of the total Golden Rose licenses area.

Concurrently, the Company has recently completed its revised and refined geological and structural property-wide synthesis of Golden Rose and is now advancing an assessment of the outcomes of this work. The completed models identify numerous targets with potential for orogenic gold mineralization across the nearly 300 sq. kilometres (“km”) land package. This pipeline of quality exploration targets will be validated by field work prior to drilling.

TRU CEO Steve Nicol commented: “We are very pleased to announce the commencement of the 2025 drill program at the Mark’s Pond to Rich House exploration fairway which represents the first area to be tested among the multiple prospective targets emerging from our geological and structural site-wide model. I look forward to updating investors on the results of this initial drilling program, and upon our ongoing assessment of other emerging target areas, as results from each become available.”

Figure 1: Initial Exploration Fairway at Golden Rose

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to the July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU Awards Drilling Contract for the 2025 Drilling Program at Golden Rose

TRU has awarded a contract to MCL Drilling to provide drilling services for an approximate 1,800 metres diamond drilling program planned for the 2025 field season at the Golden Rose Project.

Toronto, Ontario – April 03, 2025 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) is pleased to report that it has awarded a contract to MCL Drilling (“MCL”) to provide drilling services for an approximate 1,800 metres (“m”) diamond drilling program planned for the 2025 field season at the Golden Rose Project (“Golden Rose”). Golden Rose is strategically located along the gold deposit bearing Cape Ray – Valentine Lake Shear Zones in Central Newfoundland.

The 2025 drilling program constitutes the first pass in a larger plan to follow up on the pipeline of quality exploration targets emerging from the revised and refined geological and structural property scale model that has been in preparation for several months and is expected to be completed shortly. The focus of the 2025 drilling program is on the Mark’s Pond to Rich House “exploration fairway”, a portion of which is host to the very high-grade gold grab samples that were collected by TRU late in 2024 (see News Release dated December 5, 2024). Drilling will commence once the target selection on the exploration fairway is complete.

TRU CEO Steve Nicol commented: “The shift to a “big picture” perspective at Golden Rose announced in October 2024 is leading to the generation of a pipeline of exploration and drill targets, with this 2025 drilling program being the first step down the road towards following up on each of the prioritised targets generated. We are very pleased to have arrived at an agreement with MCL for the provision of the drilling services and excited about working with this very experienced and well-regarded local drilling and civil works company to efficiently execute the 2025 drilling program. I look forward to updating investors on the results of this initial drilling program, and on results of subsequent follow-up works on the other targets generated by our “big picture” review across the remaining project area, as results become available.”

Drilling Contact

Following a competitive tendering process that began in February 2025, TRU selected MCL as the preferred tenderer. MCL will provide all drilling and reclamation services with mobilisation currently expected in the Spring 2025. The 2025 drilling program is planned to comprise approximately1,800 m of diamond drilling, depending upon results or conditions encountered.

2025 Drilling Program

In October 2024, the Company reported on its shift to a “big picture” view of Golden Rose embarking on the preparation of a revised and refined geological and structural property scale model with the view to identifying multiple targets across the nearly 300 sq. kilometres (“km”) land package. The initial focus of this work is on the Mark’s Pond to Rich House exploration fairway. (See News Release dated October 22, 2024).

Figure 1: Initial Exploration Fairway at Golden Rose

The Mark’s Pond to Rich House exploration fairway, which is approximately 7.5 km long and up to 2 kms wide (see Figure 1) and forms part of the Staghorn licenses, was selected for the initial exploration and drilling focus based upon its interpreted prospectivity and to comply with certain drilling commitments required prior to early July 2025 pursuant to the terms of the Option Agreement with Quadro Resources, as modified, on the Staghorn licenses. (see News Releases dated June 16, 2022 and August 18, 2022).

The Staghorn licenses cover areas of significant exploration potential and include the Mark’s Pond gold zone where past drilling has provided intercepts including 3.22 grams per tonne gold (“g/t Au”) over 5.0 m, the Northcott gold zone where trenching has returned samples including 57.6 g/t Au over 2.5 m, 34.0 g/t Au over 2.0 m, and 23.5 g/t Au over 2.0 m, and also includes the area which is host to the very high-grade gold grab samples that were collected by TRU late in 2024 near Rich House (see News Releases dated January 12, 2023, December 5, 2024 and NI 43-101 Technical Report on the Golden Rose Project, Newfoundland Labrador, Canada dated October 11, 2023 on the Company’s website).

The Staghorn licenses represent less than 12% of the total Golden Rose licenses area.

The eventual locations of the drill holes for the 2025 drilling program will be determined when the final results of the property scale target generation work are completed and interpreted.

The scientific and technical information disclosed in this news release has been prepared and approved by Joel Cranford, P.Geo., Project Geologist for TRU, and a Qualified Person as defined in NI 43-101.

About MCL Drilling

MCL Drilling, a division of Major’s Contracting Ltd, is a privately-owned, family business with more than 40 years experience in the fields of construction, civil works, drilling, and forestry. Based locally out of Deer Lake, Newfoundland, MCL is recognised throughout Newfoundland for it’s innovative and high quality work, performed to the highest standards of safety and environmental protection. MCL also prides itself on its record for sustainable diversity in its employment decisions. With its fleet of seven diamond drill rigs, MCL has safely and successfully completed over 120,000 metres of diamond drilling since 2020.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to our July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU Announces Change of Corporate Secretary

TRU announces that Heran Zhou will be stepping down from his role as Corporate Secretary effective February 1, 2025.

Toronto, Ontario – January 31, 2025 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) announces that Heran Zhou will be stepping down from his role as Corporate Secretary effective February 1, 2025. Mr. Zhou has held the position since October 1, 2022.

Olga Nikitovic, the Company’s President and Chief Financial Officer will assume the additional role of Corporate Secretary.

The Board would like to thank Mr. Zhou for his invaluable contributions to the Company and wish him success in his future endeavors.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently subject to an Earn-In Agreement with TSX-listed Eldorado Gold Corporation (“Eldorado”), whereby Eldorado has the option to fund CAD15.25M in cash payments and exploration expenditures over 5 years to earn an 80%-interest in the Golden Rose project. Please refer to our July 30th, 2024 press release for further details of the agreement.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements

This press release contains certain forward-looking statements. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

This press release is solely the responsibility of TRU, and Eldorado is not in any way responsible or liable for the contents hereof.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU Reports High Grade Gold in Rock Samples recovered from the Golden Rose Project

TRU Precious Metals Corp. reports on high grade gold assays from rock sampling and mapping carried out on a section of the company-defined Mark’s Pond to Rich House exploration fairway at its flagship Golden Rose Project.

Toronto, Ontario – December 5, 2024 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) is pleased to report on high grade gold (“Au”) assays from rock sampling and mapping carried out on a section of the company-defined Mark’s Pond to Rich House (“MPRH”) exploration fairway at its flagship Golden Rose Project (“Golden Rose”). The Golden Rose project is strategically located along the gold deposit-bearing Cape Ray – Valentine Lake Shear Zone in Central Newfoundland.

Highlights

Sampling and mapping were carried out along a 15 metre (“m”) wide strip along the north shore of Lake Victoria made possible by unusually low water levels. This strip represents partial exposure of a 4 km stretch along the MPRH exploration fairway;

A total of 47 bedrock and float grab samples were collected along the exposed shoreline, with 22 having grades in excess of 0.1 grams per tonne (“g/t”) Au, of which 8 returned grades in excess of 30 g/t Au including 4 which returned grades in excess of 100 g/t Au;

12 of the bedrock and float samples contained visible gold (“VG”);

A new bedrock occurrence with Rich House type alteration and veining was discovered approximately 1,100 m southwest (“SW”) of Rich House; and

The exposed north shore provided valuable geological information on what is interpreted to be a portion of a highly prospective structural trend extending through much of the large Golden Rose property.

CEO Statement

TRU CEO Steve Nicol commented: “The impressive grade results returned from this program of rock sampling signals that Golden Rose has the potential to generate high grade gold, but more significantly this rare exposure of lake shore has exposed a portion of the larger structural trend that is interpreted to extend for some 33 kms from NE to SW across the Golden Rose property. As only minimal information is currently available along the trend due to bog and till cover, studying this exposed lake shore provides valuable insight into some of the controls on gold mineralization occurring along this larger trend. The collection of many high-grade rock samples, some containing VG, also reinforces the Company’s selection of the MPRH exploration fairway as the focus for initial drill planning. It is a credit to the TRU geological team that it recognized the importance of the opportunity afforded by the unexpectedly low water levels within Victoria Lake and moved quickly to take full advantage of the opportunity.”

Sampling and Mapping

As previously reported (see news release dated October 22, 2024), TRU is in the process of rigorously and methodically assessing the project-wide data for Golden Rose, including geological re-evaluation, infill sampling, and field validation with the objective of developing an updated model of mineralization potential across the entire project area. The initial focus is on the MPRH exploration fairway where drilling is being planned.

The MPRH exploration fairway is a structural corridor interpreted to be up to 2 kilometres (“km”) wide and over 7 km long, stretching from the Mark’s Pond gold zone in the southwest to the Rich House showing to the northeast (“NE”) (Figure 1). For several kilometres, the MPRH exploration fairway is parallel to the northwest shore of Victoria Lake.

FIGURE 1: MPRH exploration fairway location

The 2024 fieldwork program was assisted by unusually low water levels in Victoria Lake leaving exposed a significant amount of the lake shore and thus uncovering a 15 metre (“m”) wide strip along the entire north shore of the lake representing a 4 km stretch of the MPRH exploration fairway.

Sampling and mapping were carried out by the TRU geological team along this strip of exposed shoreline. Bedrock samples were taken from siliceous intervals associated with a contact zone exhibiting iron carbonate alteration that can be tracked over an extensive strike length. Individual siliceous intervals extend to a width of up to 4 m, over 10’s of metres in length. Many of the float samples collected were from angular boulders suggesting that they may not have been transported very far from the original source. A table of samples that returned in excess of 0.1 g/t from the sampling program is provided below (Figure 2). Figure 3 shows the locations of significant samples along the shoreline, close to Rich House.

FIGURE 2: Table of significant sample results (> 0.1 g/t Au)

FIGURE 3: Grab sample locations and assays with geology close to Rich House

The MPRH exploration fairway forms part of a larger structural trend interpreted to extend for some 33 kms in a NE to SW direction across the Golden Rose property. The geology of this structural trend is complex with numerous sedimentary and volcanics lithologies existing as overlapping thrust slices over 10’s of kms. The trend is interpreted to be highly prospective for Au along its entire length but has limited surface expression. The opportunity provided TRU geologists by the recently exposed Lake Victoria shoreline in a portion of the MPRH exploration fairway provides a valuable source of geological information which will assist to advance TRU’s discovery aims for Golden Rose in this much larger structural trend.

High resolution drone imagery has also been collected over the exposed shoreline to document the outcrops for further geological interpretation.

Data Verification

During all exploration sampling and analysis works on its Golden Rose Project, TRU maintains strict quality assurance and quality control programs and has a sample security procedure in place. These are tailored as necessary to be appropriate to the types of samples being collected.

Samples reported on in this news release comprised rock chip and grab samples. These samples were all packed in sealed plastic bags and transported by the TRU Project Geologist directly to the laboratories of Eastern Analytical in Springdale, NL (ISO 17025 certified) for industry standard assay techniques for gold.

All samples containing VG were assayed using total pulp metallics as well as ICP-34 while the remaining samples were analyzed by 30g fire assay with AA finish and ICP-34 techniques. Blank and standard samples were inserted by the laboratory in addition to analysis of duplicate samples.

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Joel Cranford, P.Geo., Project Geologist for TRU, and a Qualified Person as defined in NI 43-101.

Joel Cranford has verified all scientific and technical data disclosed in this news release and noted no errors or omissions during the data verification process.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The Company’s flagship project is the Golden Rose Project, a regional-scale 297.5 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Gold Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting discovery along this proven gold bearing trend.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Cautionary Statements – Preliminary Results

The results obtained from the exploration works subject of this news release are comprised of grab samples from outcrop and float. They are preliminary in nature and not conclusive evidence of the likelihood of the occurrence of a deposit.

The potential quantity and grade of metals and minerals in Golden Rose is conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Cautionary Statement - Forward-Looking Statements

This press release contains certain forward-looking statements, including those relating to exploration and drilling plans at Golden Rose. These statements are based on numerous assumptions regarding Golden Rose, the Company’s exploration programs and results, and commodities prices that are believed by management to be reasonable in the circumstances, and are subject to a number of risks and uncertainties, including without limitation: mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on Golden Rose; the exploration potential of Golden Rose and the nature and style of mineralization at Golden Rose; risks inherent in mineral exploration activities; volatility in precious metals and base metals prices; volatility in economic conditions and financial markets; and those other risks described in the Company’s continuous disclosure documents. Actual results may differ materially from results contemplated by the forward-looking statements herein. Investors and others should carefully consider the foregoing factors and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements herein except as required by applicable securities laws.

Neither TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

TRU Copper Exploration Program Returns Samples assaying 3.7% and 3.2% Cu at Golden Rose

TRU Precious Metals Corp. provides results from the 2024 field season copper exploration program at its flagship Golden Rose Project strategically located along the gold deposit-bearing Cape Ray – Valentine Lake Shear Zone in Central Newfoundland.

Toronto, Ontario – November 5, 2024 – TRU Precious Metals Corp. (TSXV:TRU, OTCQB:TRUIF, FSE:706) (“TRU” or the “Company”) is pleased to provide results from the 2024 field season copper (“Cu”) exploration program at its flagship Golden Rose Project (“Golden Rose”) strategically located along the gold deposit-bearing Cape Ray – Valentine Lake Shear Zone in Central Newfoundland. As previously announced (see news releases dated April 18, 2024 and July 16, 2024), TRU has been conducting a targeted exploration program focused on the critical minerals potential of Golden Rose, with special emphasis on copper. Many of the areas targeted have limited exploration to date as Golden Rose is an historically underexplored asset.

The Jacob’s Prospect and King George Prospect areas both returned significant copper values (up to 3.7% Cu) while other locations returned numerous anomalous values, upgrading these targets for future work (Figure 1).

Highlights from the recently completed program are:

At Jacob’s Prospect, four samples comprising bedrock and float assayed from 2.0% to 3.7% Cu with numerous other rock samples assaying up to 1% Cu. This has extended the area of known copper potential at this prospect by approximately 2 kilometres (“km”) to the west-northwest;

At King George Prospect, outcrop and angular float grab samples assayed 3.7% and 2.4% Cu;

At Glenn’s Prospect, outcrop samples returned values up to 0.9 % Cu extending the area of known copper potential by 750 metres (“m”) to the southwest of the original outcrop reported in 2023 (See news release dated October 03, 2023);

Outcrop and angular float samples with highly elevated copper concentrations have been collected over a 5.5 km strike of the Cape Ray Shear Zone from Glenn’s Prospect to Jacob’s Prospect, with similar elevated copper concentrations also obtained from outcrop and angular float approximately 14 km further along the same structure to the southwest at King George Prospect;

Outcrop samples assaying up to 0.17 % Cu, as well as angular float boulder samples assaying up to 0.15% Cu and 1.4 grams per tonne (“g/t”) gold (“Au”) were discovered at the new Annie Prospect, a previously unexplored area 3.5 km north-northeast of Glenn’s Prospect; and

Several samples collected across the above-noted prospects also assayed anomalous zinc (“Zn”) values up to 0.95% Zn.

TRU CEO Steve Nicol commented: “We are very encouraged with the results of our latest exploration program, specifically targeting copper and other critical minerals at various locations within the nearly 300 sq.km Golden Rose Project area. This work continues to highlight the potential of the Project to host significant critical mineral occurrences. Further work is required to better evaluate the full potential of these occurrences. We look forward to working with our Golden Rose earn-in partners Eldorado Gold Corporation (“Eldorado”) to incorporate this latest information into the ongoing preparation of a revised and refined project-wide geological and structural model for Golden Rose” (See news release dated October 22, 2024).

Figure 1: Sample locations providing elevated copper results from the 2024 Cu exploration program

The Cu exploration program comprised prospecting, grab (rock) sampling and reconnaissance soil sampling and was undertaken over areas where previous work identified critical mineral prospectivity and also at locations highlighted by remote sensing work.

At Jacob’s Prospect (previously known as Jacob’s Pond and Jacob’s Twin), results include outcrop and angular float grab samples assaying 3.7%, 3.2%, 2.4% and 2.0% Cu, with numerous other Cu mineralized samples identified over a 1.5 km length and samples assaying up to 0.95% Zn. Rock types identified are mafic volcanics with massive, semi-massive and disseminated sulphide mineralization. Antimony (“Sb”) grades up to 0.2% Sb are also present. The Cu mineralization is interpreted as being associated with an east-west trending splay off the Cape Ray Shear Zone, with many of the anomalous samples taken from an area 1.4 km north of the 2022 drilling at Jacob’s Twin (see news release dated September 22, 2022) thereby extending the previously known anomalous copper zone significantly to the west-northwest by approximately 2 km.

At King George Prospect, results include outcrop and angular float grab samples assaying 3.7% and 2.4% Cu, with up to 0.9% Zn also encountered over an area of approximately 500 m x 500 m. The prospect lies in the area of an extensive geophysical anomaly. Rock types sampled are mafic volcanics with disseminated and fracture fill Cu and Zn mineralization.

At Glenn’s Prospect, the copper potential is supported by outcrop samples assaying up to 0.9 % Cu in the area surrounding the initial discovery outcrop. Rock types sampled are mafic volcanics and diabase hosting disseminations and fracture filling sulphide mineralization extending up to 750 m southwest of the initial discovery at Glenn’s Prospect.

At the new Annie Prospect, located in the Annieopsquotch Mountains, outcrop and angular float boulder samples assayed up to 0.17% Cu and up to 1.4g/t Au. Satellite and remote sensing data had previously indicated the potential for critical mineral prospectivity over parts of the Annieopsquotch Mountains. The discovery of elevated copper values in this area based solely on remote sensing data gives confidence that this data set can be used to identify additional base and precious metals mineralization zones at Golden Rose for future exploration.

Results from a soils program at the King George Prospect are pending.

Qualified Person Statement

The scientific and technical information disclosed in this news release has been prepared and approved by Joel Cranford, P.Geo., Project Geologist for TRU, and a Qualified Person as defined in NI 43-101. Joel Cranford has verified all scientific and technical data disclosed in this news release and noted no errors or omissions during the data verification process.

About TRU Precious Metals Corp.

TRU (TSXV:TRU, OTCQB:TRUIF, FSE:706) is on a mission to build long-term shareholder value through prudent natural resource property development. The company’s flagship project is the Golden Rose Project a regional-scale 297.50 km2 land package in Central Western Newfoundland (includes a 33.25 km2 package of claims over which TRU has an option with TSX-listed Quadro Resources to acquire up to an aggregate 65% ownership) which straddles a 45 km strike length along the gold deposit-bearing Cape Ray - Valentine Lake Shear Zone, directly between Calibre Mining’s Valentine Project and AuMEGA Metals’ Cape Ray Gold Project. TRU is currently focused on efficiently discovering the full gold and copper potential at Golden Rose, targeting continuity along this proven gold bearing trend. The Golden Rose Project is currently optioned-out to TSX-listed Eldorado Gold Corporation.

TRU is approximately 36%-owned by European strategic investor Ormonde Mining plc (AQSE:ORM).

For further information about TRU, please contact:

Steve NICOL

CEO

TRU Precious Metals Corp.

Phone: 1-855-760-2TRU (2878)

Email: ir@trupreciousmetals.com

To connect with TRU via social media, below are links:

Acknowledgement

TRU would like to thank the Government of Newfoundland and Labrador for financial support through the Junior Exploration Assistance Program and the Federal Government for its critical mineral assistance funding for the exploration activities at Golden Rose.

Forward-Looking Statements